Used Car Prices Remain Sky-High

Remember when a 5-year-old sedan could be yours for $15,000? These days, even a “bargain” on the used lot feels like bidding at an auction. Used car prices are now about 40% higher than before the pandemic, and the government’s Consumer Price Index (CPI) — which tracks price changes over time — shows used cars at one of the highest levels in decades (rising far above normal inflation).

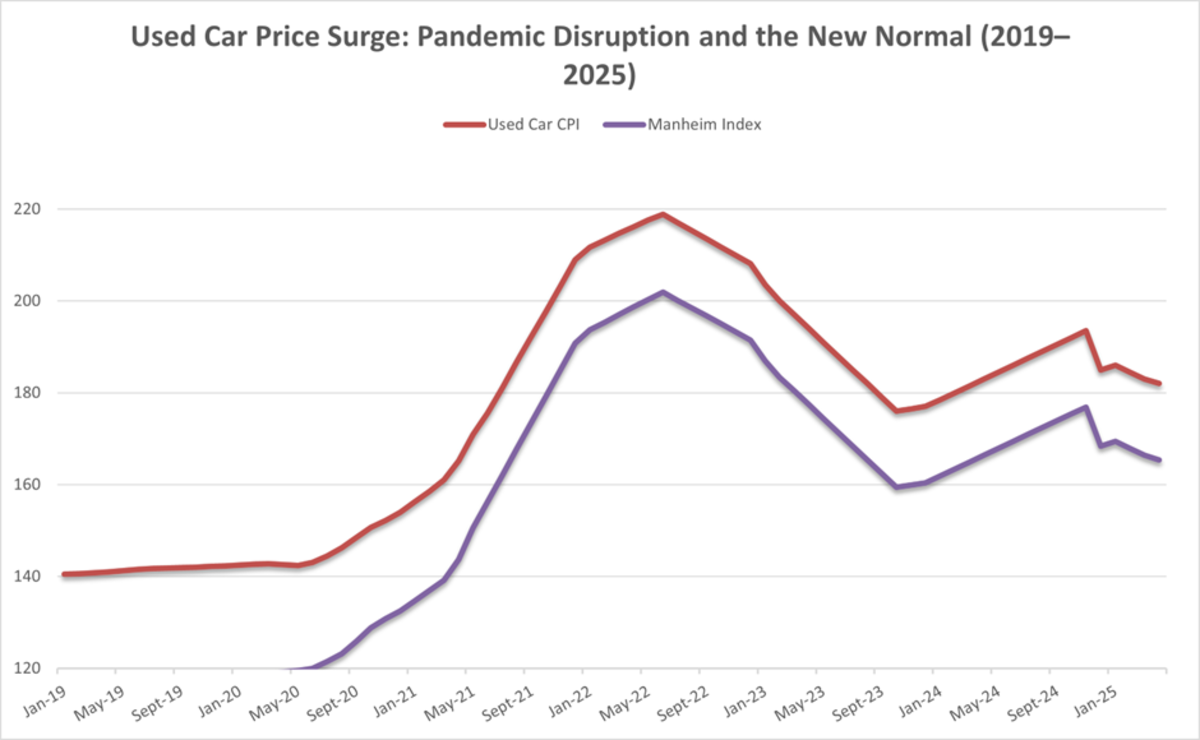

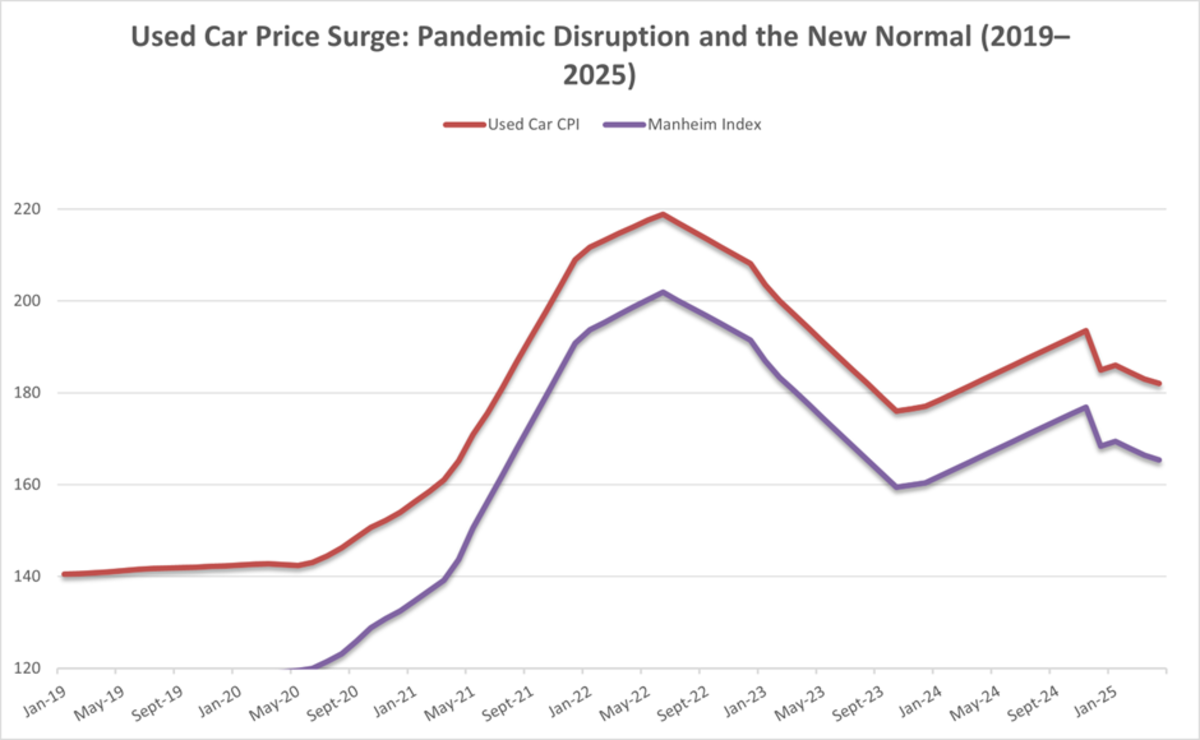

From 2005 to 2020, the CPI for used cars barely budged, rising from about 98 to 101. But since the pandemic, prices have soared: in May 2025, the index hit 184, up sharply from 130 in January 2020. After a 60% surge from early 2020 to mid-2022, prices have only eased slightly and remain stubbornly high.

With no signs that record-high used car prices will ease anytime soon, did the pandemic simply patch a broken market, or did it rewrite the rules for good? Let’s find out.

A Brief History of the Wild Ride

Used car prices were relatively flat for the last two decades. And then the pandemic. It reset the market, pushing prices far above anything seen since the early 2000s and creating a new, more expensive normal for buyers. Factory shutdowns and surging demand sent the used car CPI from 130 in January 2020 to 209 by June 2022. When supply halves and demand doubles, “normal” depreciation disappears and bargain-hunting becomes like panning for gold.

Figure 1: Monthly Used Car Consumer Price Index (CPI) and Manheim Used Vehicle Value Index, January 2019–May 2025.

This chart is crucial to understand what is going on. It screams at us “this is the new normal”. The key thing to note here is lock-step. When depreciation is in lock-step with the CPI, we are in completely new territory. What you knew as “normal depreciation” is gone. It shows retail and wholesale prices rising and falling together since 2019. The pandemic erased normal depreciation, pushing used car values to a new, higher baseline — a shift that still defines today’s market. What you can also clearly see in the chart is recent volatility; it’s all over the place. It seems volatility is another feature of the new normal.

Pandemic Shock vs. Demand Hangover

Dealers still debate home-delivery auctions versus in-person haggling. Wholesale indexes like Manheim’s surged 30% year-over-year in early 2022, then reversed gradually. Tip: wholesale vs. retail — wholesale dips don’t always translate to sticker cuts; carrying costs and financing rates keep margins tight. Range anxiety for buyers now really means wondering if a $400 monthly payment on a seven-year-old SUV was madness or a survival tactic.

Crunching the Numbers: Depreciation and Price Index

Today’s average listing sits near $25,500. Compared with pre-COVID values, that’s 30–40% higher. Factor in maintenance, AAA’s 2024 estimate is 10.13 cents per mile, or ~$1,519/year at 15,000 miles; insurance up 10–15%; financing rates flirting with new-car levels. Ironically, you pay more for a decade-old sedan than you did for a new model 5 years ago.

Rituals of the Hunt: From Auctions to Online Scans

Saturday morning lots remain ritual: tailgate meetups, engine rev demos, testers chewing on breakfast burritos. Online apps add alerts: “Price dropped $200!” evokes a dopamine hit like finding a hidden highway shortcut.

Tip: negotiation tactics — know the true market by checking multiple sources.

There’s almost reverence in cleaning someone else’s coffee stain from the seat before a test drive. It’s communion among gearheads and bargain seekers. The pandemic boom taught us that used-car prices can surge like race-day adrenaline — and the bust reminds us of gravity.

If you’re waiting for used car prices to “return to normal,” you might be waiting a good while. The new normal is higher prices, fewer bargains, and a market that can turn on a dime. The best advice? Shop smart, check multiple sources, and move quickly when you spot value. Because in this market, volatility isn’t just a phase — it’s probably the road ahead.

In the end, all we want is that familiar engine rumble and the thrill of a deal that smells like possibility — even if the sticker still stings. At every mile, the used-car market whispers its own story: one of scarcity, strategy, and stubborn passion.