How to Import Cars to India Without Paying Import Duty Using ATA Carnet

How to Import Cars to India Without Paying Import Duty Using ATA Carnet

How to Import Cars to India Without Paying Import Duty Using ATA Carnet

The idea of importing a luxury or high-performance car into India is appealing to many automotive enthusiasts. However, the high import duties can make this dream seem out of reach. Fortunately, there is a way to legally bring a car into India temporarily without paying these duties, and that is through the ATA Carnet. This article will explore how the ATA Carnet works and how you can use it to your advantage.

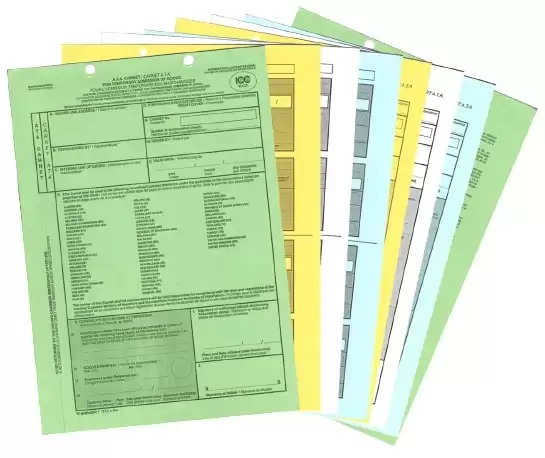

What is an ATA Carnet?

An ATA Carnet is an international customs document that allows the temporary importation of goods, including vehicles, without paying import duties and taxes. The term "ATA" stands for "Admission Temporaire/Temporary Admission," and it is recognized by over 80 countries, including India. The carnet serves as a passport for your car, allowing it to enter and exit a country without the usual customs procedures.

How Does the ATA Carnet Work?

The ATA Carnet is issued by chambers of commerce in the country of origin and is valid for one year. It allows the holder to temporarily import a vehicle into a foreign country for specific purposes, such as exhibitions, races, or personal use, without paying customs duties. When the vehicle is brought back to the country of origin, the carnet is discharged, proving that the vehicle was re-exported.

Advantages of Using an ATA Carnet

- Duty-Free Importation: The most significant advantage of using an ATA Carnet is that it allows duty-free importation of vehicles into India.

- Simplified Customs Procedures: The ATA Carnet simplifies customs clearance processes, as it eliminates the need for multiple customs documents.

- International Recognition: The ATA Carnet is recognized in over 80 countries, making it a versatile option for frequent travelers.

- Cost-Effective: While there are costs associated with obtaining an ATA Carnet, these are generally much lower than paying full import duties.

Eligibility Criteria for Importing Cars Using ATA Carnet

Not all cars or individuals are eligible to use an ATA Carnet for importing vehicles into India. The carnet is typically used for vehicles that are being imported temporarily for purposes like:

- Participation in exhibitions or trade fairs

- Sports events or rallies

- Testing and research

- Personal use during short stays

Types of Vehicles Eligible for ATA Carnet

Most vehicles, including cars, motorcycles, and trucks, can be imported using an ATA Carnet as long as they are intended for temporary use and will be re-exported. This includes:

- Luxury cars

- Classic or vintage cars

- Race cars

- Motorcycles

- Commercial vehicles for exhibitions

Step-by-Step Process to Import Cars Using ATA Carnet

7.1 Obtaining an ATA Carnet

The first step in importing a car using an ATA Carnet is to obtain the carnet itself. This can be done through your local chamber of commerce. You will need to provide details about the vehicle, its intended use, and the countries you plan to visit.

7.2 Preparing the Vehicle for Import

Before shipping your car to India, ensure that it meets the necessary safety and environmental standards. This includes making sure the car is roadworthy and that all documentation, including the vehicle registration and insurance, is in order.

7.3 Submitting Required Documentation

Along with the ATA Carnet, you will need to submit other documents such as the vehicle's registration certificate, insurance papers, and a detailed list of any spare parts or equipment being imported with the car.

7.4 Clearing Customs in India

When the car arrives in India, you will present the ATA Carnet to Indian customs officials. They will inspect the vehicle and the carnet, after which the car will be allowed to enter the country without the payment of import duties.

Duration of Stay for Vehicles Imported Using ATA Carnet

Vehicles imported using an ATA Carnet can stay in India for up to six months. However, the exact duration may vary depending on the specific terms of the carnet and the purpose of the vehicle's importation. It is essential to adhere to these timelines to avoid penalties or complications.

Restrictions and Limitations of ATA Carnet

While the ATA Carnet offers significant benefits, it is not without its limitations:

- Temporary Import Only: The car must be re-exported out of India within the stipulated time.

- No Sale Allowed: Vehicles imported under ATA Carnet cannot be sold or transferred in India.

- Limited to Specific Purposes: The carnet is typically only valid for specific purposes like exhibitions, testing, or personal use.

Costs Involved in Using an ATA Carnet

Obtaining an ATA Carnet involves certain costs, including:

- Application Fees: Charged by the chamber of commerce.

- Security Deposit: Often required to cover potential duties if the vehicle is not re-exported.

- Insurance: To cover the car during its stay in India.

Despite these costs, they are generally lower than the import duties you would otherwise have to pay.

Common Mistakes to Avoid When Using an ATA Carnet

- Not Re-Exporting on Time: Failing to re-export the vehicle within the carnet's validity period can result in penalties and payment of duties.

- Incorrect Documentation: Ensure all paperwork is accurate and complete to avoid delays at customs.

- Using the Vehicle for Unauthorized Purposes: The vehicle should only be used for the purpose stated in the carnet.

Case Study: Successful Importation of a Car Using ATA Carnet

Consider the case of a vintage car enthusiast who wanted to bring his classic Jaguar to India for a vintage car rally. By obtaining an ATA Carnet, he was able to import the car duty-free, participate in the event, and then re-export the car without any customs issues. The entire process was smooth and cost-effective, thanks to the carnet.

ATA Carnet vs. Temporary Importation Permit (TIP)

While both the ATA Carnet and TIP allow for the temporary importation of vehicles, the ATA Carnet is often more straightforward and internationally recognized. TIPs, on the other hand, are country-specific and may have more restrictions.

How to Renew or Extend Your ATA Carnet

If you need to keep your vehicle in India for longer than the initial period allowed by the ATA Carnet, you can apply for an extension. This must be done before the carnet expires, and you will need to provide a valid reason for the extension.

Conclusion

Importing a car to India without paying import duties is possible with the ATA Carnet, provided you follow the correct procedures and use the vehicle for its intended purpose. The ATA Carnet simplifies the process, making it easier and more affordable to bring your car into India temporarily. Whether you're an exhibitor, a racer, or just a car enthusiast, the ATA Carnet is a valuable tool to help you navigate the complexities of international vehicle importation.

FAQs

-

What is the maximum duration a car can stay in India under an ATA Carnet?

- Typically, a car can stay in India for up to six months under an ATA Carnet, but this may vary depending on the specific terms.

-

Can I sell my car in India if I import it using an ATA Carnet?

- No, vehicles imported under an ATA Carnet cannot be sold or transferred in India.

-

How long does it take to obtain an ATA Carnet?

- The process can take a few days to a couple of weeks, depending on the issuing authority and the completeness of your application.

-

What happens if I don't re-export the car within the allowed period?

- Failure to re-export the car within the allowed period can result in penalties and the requirement to pay full import duties.

-

Is an ATA Carnet valid for multiple entries into India?

- Yes, an ATA Carnet allows for multiple entries and exits within its validity period.