Lease vs. Buy: Which Option Saves You More Money?

1. Introduction

hen faced with the decision of acquiring a vehicle or equipment, one of the most crucial questions is whether to lease or buy. Both options come with their own set of advantages and drawbacks, and the choice between them can significantly impact your financial well-being. This article delves into the intricacies of leasing and buying, providing you with the insights needed to make an informed decision that best suits your financial goals and lifestyle.

2. Understanding Leasing

What is Leasing?

Leasing is essentially a long-term rental agreement where you pay to use a vehicle or equipment for a specified period, usually two to four years. At the end of the lease term, you typically have the option to purchase the item at its residual value, return it, or lease a new one.

Types of Leasing

There are several types of leasing, including:

- Closed-End Lease: Also known as a “walk-away” lease, you return the item at the end of the term without any further obligation.

- Open-End Lease: Typically used by businesses, where you may owe additional money if the item’s value at the end of the lease is less than the residual value.

- Single-Payment Lease: A lease where you pay the entire lease amount upfront, often at a discount.

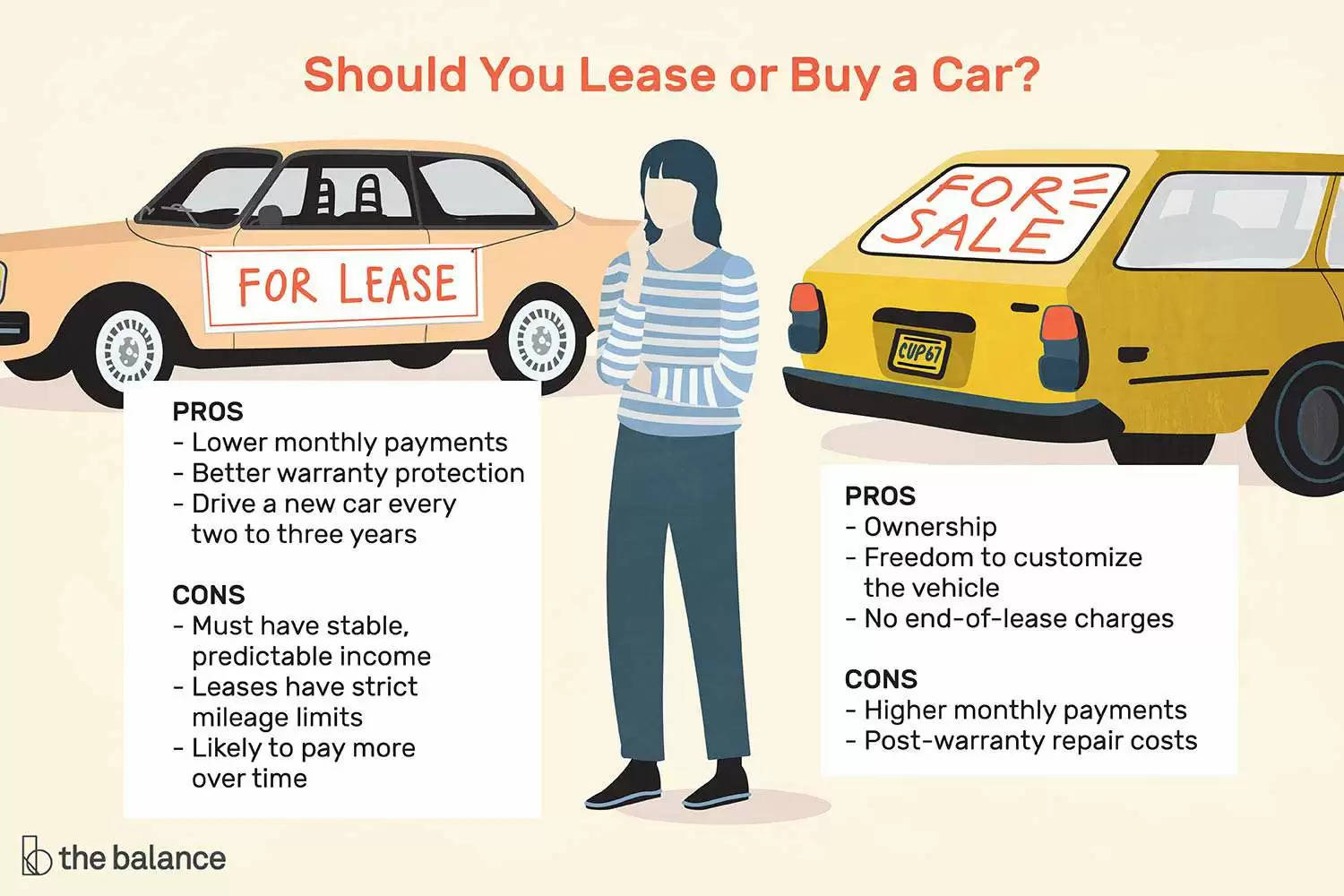

Pros and Cons of Leasing

Pros:

- Lower monthly payments compared to buying.

- Ability to drive a new car or use the latest equipment every few years.

- Less worry about depreciation or resale value.

Cons:

- No ownership, meaning no equity is built.

- Mileage restrictions and potential overage fees.

- Higher long-term costs if you continue to lease indefinitely.

3. Understanding Buying

What is Buying?

Buying involves paying the full purchase price of a vehicle or equipment, either upfront or through financing. Once purchased, the item is yours to keep, sell, or trade-in as you wish.

Financing Options for Buying

Common financing options include:

- Auto Loan: Borrowing from a bank or financial institution to pay for the vehicle, which you repay with interest over a set period.

- Dealer Financing: Financing provided by the dealership, often with promotional rates.

- Personal Loan: A loan taken for any purpose, including buying a vehicle or equipment.

Pros and Cons of Buying

Pros:

- Full ownership and the ability to customize the item.

- No mileage restrictions.

- Potential to recover some costs through resale.

Cons:

- Higher monthly payments than leasing.

- Depreciation affects the resale value.

- Full responsibility for maintenance and repairs after the warranty expires.

4. Cost Comparison

Initial Costs

Leasing often requires a smaller down payment or none at all, whereas buying usually involves a larger upfront payment.

Monthly Payments

Leasing generally offers lower monthly payments than buying, but these payments never end if you continue to lease. Buying, on the other hand, might have higher monthly payments, but they end once the loan is paid off.

Long-Term Financial Impact

Over the long term, buying is usually more cost-effective since you eventually own the item outright and can sell it. Leasing might seem cheaper initially but can be more expensive if done continuously.

5. Depreciation and Resale Value

Depreciation Explained

Depreciation refers to the loss of value over time, a significant factor in buying decisions. Vehicles and equipment lose value the moment they are used.

Resale Value in Buying

When buying, you need to consider the item’s resale value. Some items hold their value better than others, which can affect the overall cost of ownership.

Impact of Depreciation on Leasing

Leasing protects you from the effects of depreciation since the lease payments are based on the expected depreciation during the lease term. However, you won’t benefit from any residual value as you would with buying.

6. Flexibility and Ownership

Flexibility in Leasing

Leasing offers flexibility, allowing you to switch to a new model or equipment every few years without the hassle of selling the old one. However, this comes with restrictions, such as mileage limits.

Ownership Advantages in Buying

Buying provides the advantage of ownership, meaning you can keep the item for as long as you want and make any modifications. Ownership can also be financially beneficial in the long run if the item retains good value.

Customization and Upgrades

When you buy, you have the freedom to customize and upgrade your vehicle or equipment to your liking, something that leasing usually does not allow.

7. Maintenance and Insurance Considerations

Maintenance Costs in Leasing

Leased items often come with a warranty covering most maintenance costs. However, you are still responsible for routine maintenance and any damages that exceed normal wear and tear.

Maintenance Costs in Buying

When you buy, you are responsible for all maintenance costs once the warranty expires. This can include expensive repairs, making it essential to factor these into your decision.

Insurance Requirements for Leasing vs. Buying

Leasing often requires higher insurance coverage to protect the leasing company’s investment. Buying allows more flexibility in choosing insurance coverage, though comprehensive coverage is still recommended.

8. Tax Implications

Tax Deductions for Leasing

Leasing can offer tax benefits, particularly for businesses. Lease payments can often be deducted as a business expense, lowering taxable income.

Tax Benefits of Buying

When you buy, you may be eligible for tax deductions related to the item’s depreciation, especially if it is used for business purposes.

9. Expert Insights and Case Studies

Expert Opinions on Leasing vs. Buying

Financial experts often recommend leasing for those who value lower monthly payments and the ability to frequently upgrade. Buying is recommended for those looking for long-term savings and the benefits of ownership.

Case Study: Cost Analysis for Different Scenarios

Consider a case study comparing the total cost of leasing versus buying over a five-year period. In this scenario, buying typically costs less in the long run, but leasing offers more flexibility and lower initial costs.

10. Future Trends in Leasing and Buying

Emerging Trends in Leasing

Leasing is becoming increasingly popular with the rise of subscription models and the growth of electric vehicles. These trends offer more flexible leasing terms and options tailored to rapidly changing technology.

Future of Buying in the Age of Electric Vehicles

As electric vehicles become more prevalent, buying may become more attractive due to lower long-term maintenance costs and the potential for government incentives.

11. Practical Applications

Tips for Choosing Between Leasing and Buying

Consider your driving habits, financial situation, and long-term goals when deciding between leasing and buying. If you drive a lot or want to customize your vehicle, buying might be the better option.

Situational Scenarios

For a young professional who values driving a new car every few years, leasing might be ideal. For a family looking to keep a car for the long haul, buying is likely the more cost-effective choice.

12. Conclusion

In summary, the decision to lease or buy depends on your personal circumstances, financial goals, and lifestyle preferences. Leasing offers lower monthly payments and flexibility, while buying provides long-term savings and ownership benefits. Carefully consider the pros and cons of each option before making your decision.

13. FAQs

What factors should I consider when deciding to lease or buy?

Consider factors such as your driving habits, financial situation, long-term goals, and the importance of ownership.

Is leasing better for businesses?

Leasing can offer tax advantages and lower upfront costs, making it a good option for businesses.

How do my driving habits impact the decision?

If you drive a lot, buying may be more cost-effective as leases often have mileage restrictions.