Tariffs have the auto industry on watch

Hours before an event in Michigan on April 29, President Trump signed two executive orders aimed at reducing the impact of trade tariffs on the automotive industry. One order prevents automakers, who face 25% tariffs on auto imports, from being subject to additional levies on materials. The other order allows automakers to apply for tariff relief, which will reduce a portion of the costs associated with their imported components. However, these benefits will be gradually phased out over the next two years.

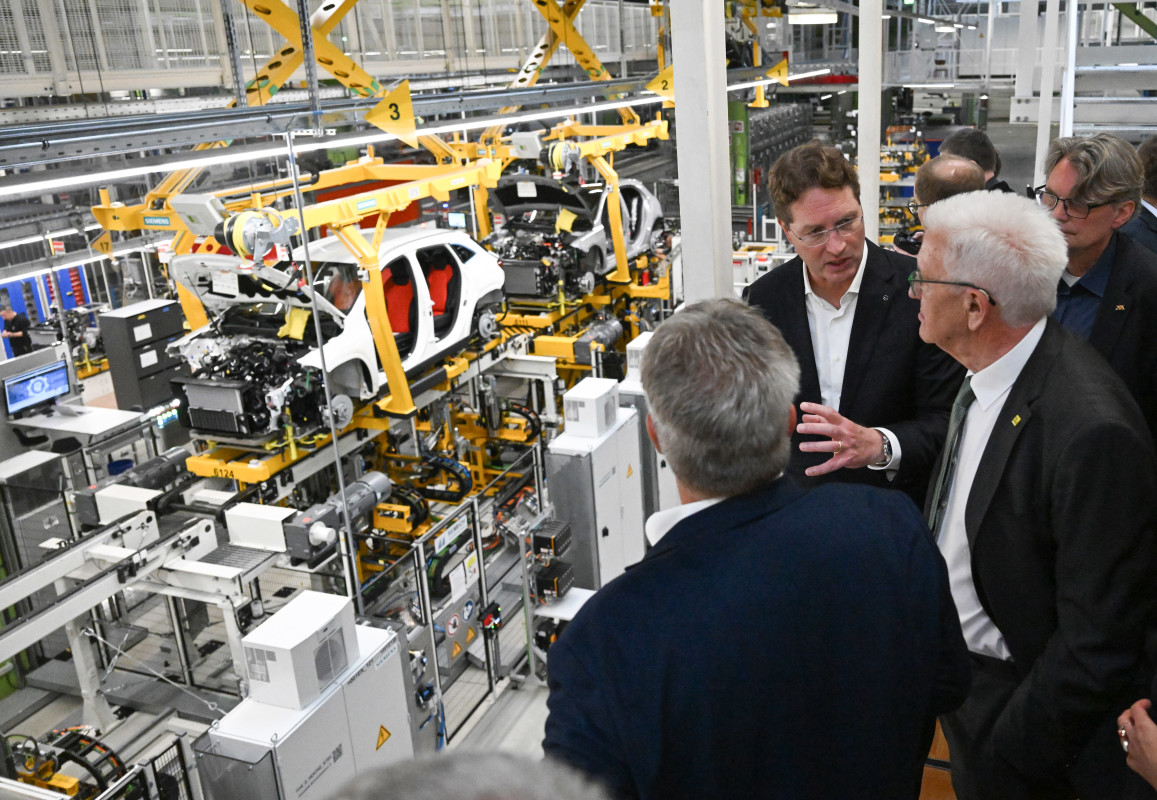

Bernd Weißbrod/picture alliance via Getty Images

During a rally that night in Michigan, Trump described this move as providing “a little flexibility” to the automotive industry, hoping to persuade automakers to produce their cars and components in the United States. He said, “We gave them a little time before we slaughter them if they don’t do this. They’re going to make so much money. They’re going to have so many jobs.”

Despite the developments, German luxury car manufacturer Mercedes-Benz withdrew its earnings guidance for 2025 during the announcement of its Q1 results. This decision was driven by uncertainty regarding the potential impact of President Trump’s tariffs on imported vehicles. The company also stated that if auto tariffs remained at their current levels, it would decrease profit margins by 300 basis points on cars and 100 basis points on vans.

Mercedes CEO offers some guidance on a potential tariff solution

In a new interview with German business publication Der Spiegel, Mercedes-Benz CEO Ola Källenius said that while he is looking at different scenarios, the kind of investments he has to make are ones that could last for decades, rather than ones made “in response to a volatile situation” such as the current US-EU tariff situation that is currently unfolding. Recognizing that the current administration has the impression “that we in Europe are closed to certain issues and only demand openness where we have strengths,” the CEO proposed a deal meant to balance its imports and exports.

Mercedes-Benz

In his proposal, Källenius would allow duty-free imports of U.S.-built cars into Europe in exchange for tariff waivers on an equal number of vehicles exported by EU automakers to the U.S., adding that it would alleviate and fulfill its desire to reindustrialize and become an attractive destination for companies to set up factories for exported goods.

“For every car that leaves the USA or Europe, a car from the other side comes in duty-free,” Källenius told Spiegel. “We have put this idea to both sides, and it is a possible component of the negotiations between the USA and the EU.”

Such a solution would work for a company like Mercedes-Benz. In the same interview, Källenius noted that Mercedes “is a major producer” of cars in the United States, adding that the company builds and sells around 350,000 vehicles in the country, which could count for consideration in trade talks.

“But the models we build and sell [in the U.S.] are not the same,” Källenius told Spiegel. “Two-thirds of the vehicles from our plant in Tuscaloosa, Alabama, are exported to 150 countries worldwide. We therefore contribute to a more balanced trade balance for the USA. We believe this should be taken into account in the negotiations.”

BMW

Ford CEO Jim Farley proposed a similar idea

Källenius’s idea of rewarding U.S. exports is roughly on the same wavelength as similar ideas proposed by other automotive CEOs. Previously, Ford CEO Jim Farley raised the idea that automakers like Ford should get credit for building cars in the United States that are shipped overseas for international consumption, noting that it is “essential” that the federal government come up with policies that encourage manufacturers to build cars for export, adding that it exports nearly as many vehicles as its brings in.

“So many of the vehicles we build here are exported around the globe,” Farley said. “Shouldn’t we get credit for that?” Around the same time Farley made those comments, the export of some high-ticket models to China, including the F-150 Raptor, Mustang, Bronco, and Lincoln Navigator, was halted due to retaliatory tariffs as high as 150% on imported vehicles.

Final thoughts

For what it’s worth, German automakers like Volkswagen, BMW, and Mercedes-Benz have a lot of leverage for a potential U.S. tariff deal, especially if they propose that German automakers receive credits based on the number of vehicles they produce in the United States.

These aren’t small potatoes, either. BMW alone manufactures some of its highest-volume models, such as the BMW X3, X4, X5, X6, X7, and XM, at its Spartanburg, South Carolina, plant, which serves both U.S. and international markets. According to data from the U.S. Department of Commerce, BMW is the largest automotive exporter by value in the U.S., shipping “more than $10 billion” of cars in 2024. American hands assemble these cars, no matter the badge or its supposed country of origin.