Hydrogen Infrastructure Limits Toyota’s Mirai Potential

Is hydrogen back? Well, Toyota thinks so and has staked a sizeable portion of its future on the Mirai fuel-cell sedan. Yet just 74 U.S. pumps feel like an oasis in California’s desert—drivers outside L.A. and the Bay Area must reroute for every fill. Dreaming of coast-to-coast freedom? Half the Golden State still can’t find a nozzle without a detour. Can this new run at consumer-oriented hydrogen FCVs be more than a mirage?

Real-World Range and High Fuel Costs Raise Concerns

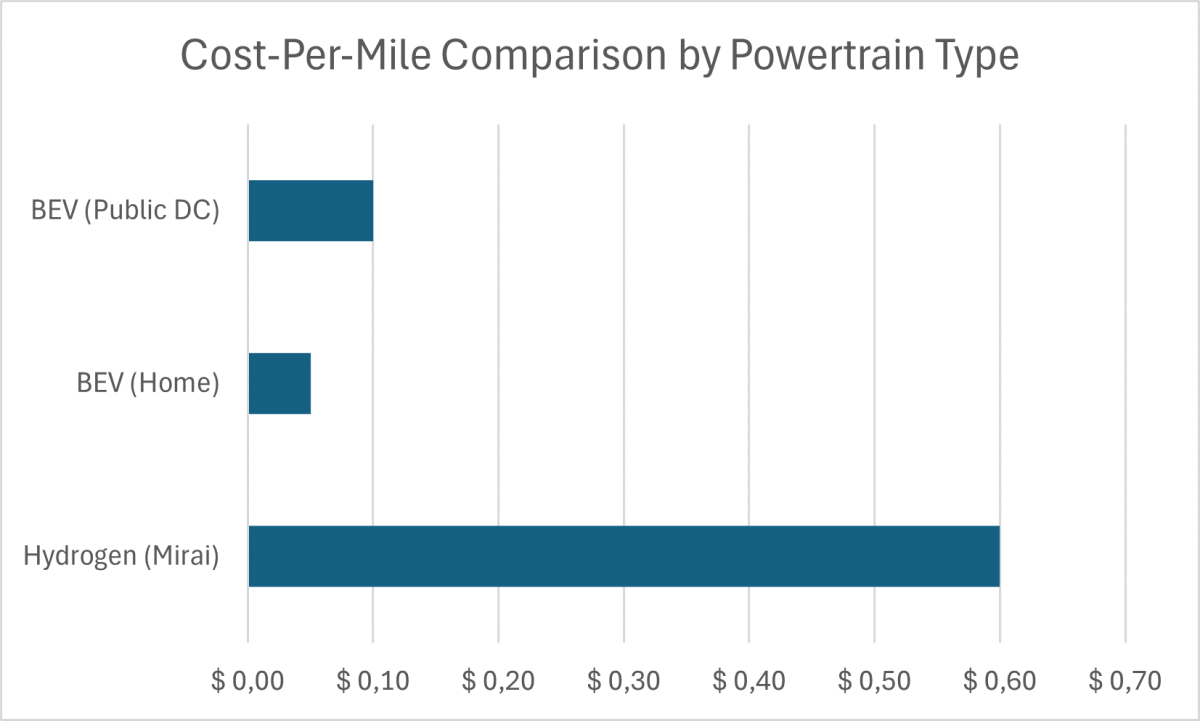

Toyota’s 402-mile EPA claim for the Mirai dazzled in March, but real-world drivers settle for closer to 320 miles under mixed conditions. Paying $36 per kilogram of H₂ in California pushes your per-mile cost past $0.60. That’s enough to make any commuter flinch when the pump light winks on.

By comparison, EV drivers pay about $0.05 per mile charging at home or roughly $0.10 per mile at public DC fast stations, while gasoline drivers incur around $0.14 per mile at $3.50/gal and 25 mpg.

Fast Fills, Long Waits: The Hydrogen Refueling Catch

EV owners endure 30-minute DC fast stops yet console themselves with having access to 30,000+ U.S. fast chargers. Mirai fans brag about a five-minute fill, then cross fingers for a working station, and then hope for no lines up ahead. That five-minute thrill can morph into a half-hour headache when infrastructure vanishes.

Toyota Bets Big on Hydrogen with Next-Gen Tech and Investments

Toyota’s third-gen fuel-cell system ups efficiency by 20% and cuts stack costs 30%, backed by $200 million in new plants and 5,600+ patents. Big rigs, buses and ships eye hydrogen’s energy density where batteries buckle. By skipping 20,000-lb battery packs, fuel-cell semis reclaim precious payload capacity—a lifeline for fleet operators that’s already spurring hydrogen-corridor pilots from coast to coast. As trucking giants and ports install high-capacity H₂ pumps, Mirai owners could reap the benefits of the very infrastructure designed to keep big rigs rolling. Where the semis go, so too Mirai.

Interestingly, Wall Street is betting the FCV market will explode from $2.5 billion today to $30 billion by 2032, seasoning Toyota’s multi-hundred-million-dollar wager. Despite earlier setbacks by other automakers, analysts now view Toyota as the true first mover in the hydrogen era. The Mirai has become a big bet, one that even Wall Street is backing.

Incentives Sweeten the Deal but Risks Remain for Buyers

Toyota’s Mirai isn’t just a concept. The second-gen Mirai has been on sale since late 2020, and the all-new 2025 model went on sale this spring, exclusively in California (only where hydrogen stations exist). You can order one now, with Toyota even sweetening the deal with up to $15,000 off complimentary hydrogen through 2031 or six years of free fuel.

Owning a Mirai today means tying your daily commute, resale value and weekend escapes to Toyota’s still-sketchy pump network. If you crave silent, zero-emission miles and you’re ready to pay a premium for pioneering status, schedule a test drive now. Just prepare your route around the stations that will make or break your hydrogen promise.